CRE commercial real estate capital call

Stress with Fundraising and Capital Calls

Let’s face it, legacy Capital Calls are stressful for GPs. Whether you’re fundraising for a new asset, or issuing a subsequent capital call for a fund, you are likely to only have a few days to collect funds from your investors. Late collections may risk meeting capital requirements for important events like deal-closing. It is mission-critical that collections happen to get your deal to close.

Let’s dive into collecting funds for the investment manager

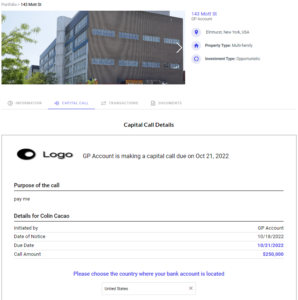

On the Covercy GP platform, we redesigned capital calls, so that you can Issue, Process and Track them in three simple steps, directly from the banking-embedded investment management software platform.

There are 3 easy steps:

- Issue: Auto-generate a request for Capital.

- Process: Collect funds with ACH debit into your primary account.

- Track: Get real time visibility into the status of each monetary transaction

with commercial real estate investment management software issue a capital call

Now you have seen what it looks like to issue a capital call directly from Covercy GP, and get your LPs to fund them automatically. This simple process helps you close your deal faster.

For more details on how to fundraise… read our knowledge base article.

We would love to show you more about investment management software and how it makes fundraising easier for you, the CRE investment manager. Book a demo.