Earn interest on your Property, Fund and GP Checking Accounts

Take advantage of Changing Shifts and Earn Interest

An Economic Shift

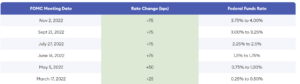

Following the rise of inflation, since March 2022 the Federal Reserve reversed a low interest rate policy that has been in effect for most of the time since the 2008 financial crisis, and certainly since the 2020 COVID pandemic began. In Nov 2022, there was a 75 bps rate change and the Federal Funds rate is 4.0%. In Dec 2022, there was another change in the Federal Funds to 4.5%.

The new environment influences most industries, and certainly real estate investments. Higher interest rates mean that loans are more expensive, inflation spikes rent prices across many sub-markets and cash in the bank is losing value. Every day.

(source: https://www.forbes.com/advisor/investing/fed-funds-rate-history/)

Most of our customers, commercial real estate investment firms, have 3-5 bank accounts per property, typically resulting in tens or hundreds of accounts across all properties, funds and GP businesses. These accounts typically store hundreds of thousands to millions of dollars. With 8% inflation you’re losing approximately $6,666 per month for every $1M cash in your accounts ($1M * 8% / 12).

Announcing: An interest yielding checking account for GPs, Funds and Properties

At Covercy we created the first Banking-Embedded Investment Management platform. Within our platform you can find the only bank account that was designed for real estate – from the ground up. It completely automates your capital calls and distribution payments, and it can be opened from Covercy GP in a few minutes, without ever having to walk to the bank.

Now you can earn interest, helping you improve the IRR of your investments.

We have three different account tiers:

| Level 3 – MAX | Level 2 – Automate & Earn APY | Level 1 – Automate IR & Banking | |

| Qualifying balance across all of your accounts combined | $3.5M – 15M | $1M – 3.5M | $0 – 120K |

| APY as of July 26, 2023 (*) | 3.82% | 3.45% | 2.54% |

| Monthly yield (*) | $10,063 – 47,750 | $2,875 – 10,063 | $0 – 254 |

It Only Takes a Few Minutes to Start to Earn Interest

Within the property or fund asset on the Covercy GP platform, you can add a new bank and fund the account with ACH Debit. You can open several accounts within an asset. If you are like several of our Investment Management clients, you will likely have 3-5 accounts per asset or fund (e.g. primary/holding, CAPEX, Operating, Security Deposit). You can have all these checking accounts right within your investment management platform. If you would like to read the details on how-to open an account.

If you want to learn more about CRE Banking on the Covercy platform built specifically for real estate, read this article .

We would love to show you more about how you can boost your IRR with our smart APY checking accounts that are designed specifically for the real estate industry to earn interest. We designed our platform to make it easier for you, the CRE investment manager. Let us know a little about your operations, and we can show you how to get started.

*Actual formula for calculating APY: If your balance is between $120,000 and $1 million (Fed Funds Rate – 0.2%) * 48%. If your balance is between $1million and $15 million, you would earn (Fed Funds Rate – 0.2%) * 65%. The above APYs represent a Fed Fund Rate of 4.5% and are true as of Dec 14, 2022

Trackbacks & Pingbacks

[…] With investor relations tools, complete fundraising capabilities, automated distributions, and high-yield accounts designed specifically for CRE firms, there’s no better platform to help you position your firm […]

[…] With investor relations tools, complete fundraising capabilities, automated distributions, and high-yield accounts designed specifically for CRE firms, there’s no better platform to help you position your firm […]

Comments are closed.