Automated Waterfall Distributions in Commercial Real Estate

Let’s learn about Waterfall Strategies

Investing strategies, methods, and benchmarks are tools of destruction for any savvy investor when competing in the contact sport called business. The waterfall strategy is one of the most useful ones.

Learn what a waterfall structure is, what it’s used for, its different types, and how to leverage it for your CRE banking & cash flow processes.

Note: Covercy is the first investment management platform to offer GPs and LPs completely customizable, end-to-end waterfall distributions via ACH debit. Simply click a button to calculate your waterfall distribution and funds are transferred directly from one bank account to another with Covercy’s preferred banking partner. Click here to book a demo & see how automated waterfall distributions with Covercy would work for your firm.

What is a waterfall structure in investing?

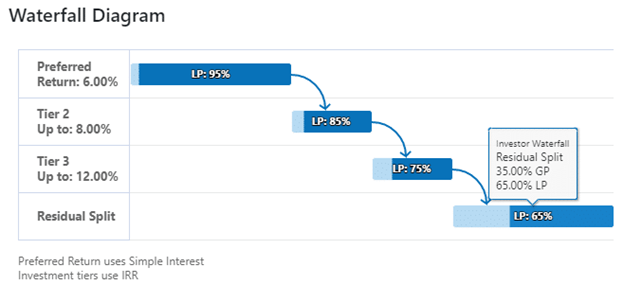

Waterfall charts, also known as distribution waterfalls, are a visual aid designed to show how capital gain returns are allocated between all investors contributing to a deal. Its name simply comes from the chart’s shape.

Waterfall structures are often associated with private equity funds and are meant to create an investors hierarchy of sorts — helping define the financial dominance of each partner in the deal, which’s usually determined by the amount of effort/capital risk each investor puts in/takes on.

Related article: Ensuring Partnership Success: The Role of Distribution Waterfalls in the GP-LP Relationship

Commonly, to incentivize the deal’s GP (general partner) to maximize profitability for its LPs (limited partners), the GP will receive a disproportionately larger share of the total profits relative to his initial investment.

Where are waterfall charts used?

Waterfall Charts are most often used in business applications, and they’re used to visually illustrate how a starting value of something becomes a final value—by showing all the additions and subtractions which occurred throughout the way.

We know it’s a bit abstract, so here’s an example of what a waterfall chart looks like:

What does a waterfall chart look like?

Source: CRE Models

What is a waterfall structure in real estate?

As mentioned earlier, waterfalls are financial structures designed to set benchmarks for real estate investors on their returns – dictating how they’ll be distributed, and show how each investor is repaid on their investment (their share of the cashflow distribution).

An example of a simple waterfall model:

A sponsor (the entity that orchestrates the project from conception to completion) who offers an 8% preferred return and then a 70/30 percent split.

In this case, the sponsor is saying that you shouldn’t expect to receive your pro-rata (in proportion) share of the distributable cash flow from a transaction until they have received an 8% return on their investment. Then, all distribution payments will be paid to equity holders until initial investments have been fully returned.

After that, you, the LP, will receive 70% of the distributions — with the remaining 30% distributed to the sponsor as a “promote.”

Note: Promote is the term used to reflect the equity and cash returns received by the “promoter,” also referred to as the general partner/sponsor/owner.

What should you know about waterfall models in commercial real estate?

First, let’s discuss the term “return hurdle”.

In CRE, the term return hurdle is a threshold defined by investors which must be met before any distributions can flow to investors, or investors of a certain tier (by equity usually).

Now, most waterfalls have multiple return hurdles, which are usually agreed upon in the contract using predefined achievements of IRR (or equity multiple).

Years of thoughtful structuring, negotiations, and creative contract clauses by savvy investors created the existence of many waterfall structures.

How are waterfalls usually structured:

By return of capital: Provisions (terms outlined in a contract) can be agreed upon; like a certain return threshold of capital to an equity investor, before a sponsor receives their share/returns.

By a capital event: when an event like a refinance, or sale of property occurs, it can result in a full return of capital provision or a unique new split (different from the ones happening during routine every month cashflow).

For example, a 70/30 split, as usual, then a refinance (capital event) causing a new 60/40 split.

By tiers: Capital events can cause a shift in distribution based on changes in the deal’s structure or yield, and two-tiered waterfall agreements can help structure hierarchy and order in such scenarios. A capital event may trigger specific clauses which distribute cash differently, not only by amount but also by segmenting investors’ tiers (usually determined by risked capital).

Actual waterfall structures:

Preferred return: Preferred are specific partners in the deal who usually have more equity. This model makes sure they get paid before distributions go further — usually 5% to 8%.

Catch-up provision: Similar to the XIRR, but requires that 100% of returns go to investors (limited partners) until a certain threshold is met. Only then, remaining funds go to general partners.

Split: After a preferred return is made, there is a split of the remaining returns, between the sponsor (general partner) and the investors (limited partner), e.g. 85/15, 90/10 or 70/30. This depends entirely on how you structured the waterfall deal, and often there are multiple split hurdles. For example:

- 80/20 until 14% IRR

- 70/30 until 18% IRR

- 60/40 above 18% IRR

Simple split: A simpler waterfall model will yield a split with no preferred return or IRR lookback. In this case, you simply split all proceeds between the equity investor and general partner. This rarely happens.

Having explored different waterfall structures, we’d like to note that in reality, most deals distribute “preferred return” all the way, except when capital events take place, in which case higher hurdles, like “deal refinancing” “asset disposition”, are typically triggered.

With strategies covered, you might still have some questions:

—

Q: Do all deals offer a preferred return?

A: No. Some projects do not offer a preferred return.

—

Q: Is the preferred return compounded?

A: When a preferred return carries over to the following year (accrues), it can be compounding or non-compounding. A compounding return with a preferred return rate of, for example, 5% will accrue interest, so $10,000 carried over will be $10,500 the following year.

—

Q: If 5% (for example) isn’t reached in a particular year, does it carry over to the next year, or does the preferred return reset each year during the project?

A: Depends on your contract’s terminology and agreements.

—

Q: Does the sponsor and Limited Partner get their return on their capital invested at the same time?

A: Usually, yes–their capital is treated similarly. But again, this depends on the terms negotiated in the agreement.

—

Q: What happens if the preferred return is not reached?

A: Like any investor, in any investment – you’ll be taking the risk of this project – knowing that the preferred return threshold, offered by the deal’s orchestrator, in the beginning, might not be achieved. The sponsor, however, has skin in the game—and a desire to make it happen. If not, he won’t be able to achieve its promote (carried interest). Preferred return was designed to put you, an LP investor first – because your capital is risked.

—

Q: Why does the sponsor deserve to earn a promote?

A: A sponsor might contribute less capital than you (the LP) towards the total equity of the deal, but often, investors forget that he will also take care of:

- Sourcing and identifying assets

- Conducting thorough due diligence

- Negotiating purchase and sale agreements

- Securing financing

Among many other things, depending on his type of sponsorship in the deal.

Q: How can I do automated waterfall distributions?

Software like Covercy has built the waterfall model into the investment management platform being used by GPs and LPs. When it’s time to calculate a distribution, the GP has to simply run the waterfall model, and the calculation and funds transfer is done automatically. By integrating banking right within the software, unlike other investment management tools on the market, Covercy gives GPs and LPs the ability to transfer money seamlessly from one bank account to the next. No need to worry about cumbersome NACHA files, wire transfers, or mailing paper checks to investors. See how it works in a complimentary demo.

——

Waterfall structured deals are difficult to describe with words alone – and reviewing actual charts will help. We covered both of these and discussed what they’re used for, specifically in commercial real estate; what to know about them, and their different structures. You would be wise to structure the deal favorably, so when targets are met throughout the deal’s lifespan and at its end, you are rewarded according to the amount of capital you risked.

*Disclaimer

Investing in commercial real estate can be risky. It is not a fit for everyone. Covercy aims to provide general information to help you better understand CRE investments, we are neither providing any investment advice nor advising for or against any particular investment.