CRE Banking

done a better way

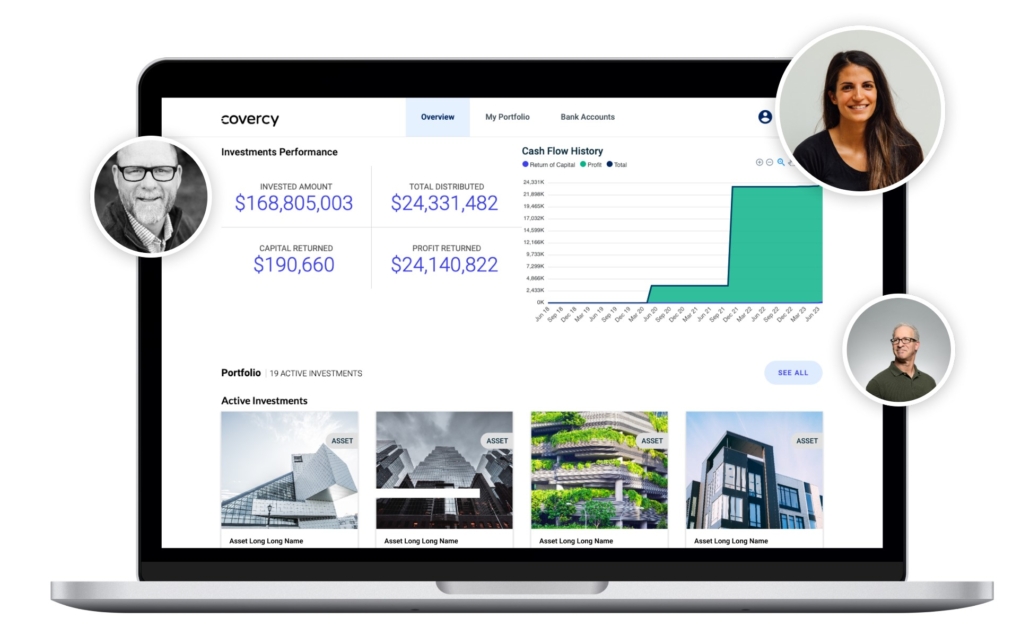

A whole new way to collect capital, distribute payments, and track assets right within your investment management platform.

|

Covercy launches AI |

We’ve just launched a new feature to enhance your experience.

A whole new way to collect capital, distribute payments, and track assets right within your investment management platform.

Traditional CRE

Banking Defined

What is traditional CRE Banking?

CRE banking, or commercial real estate banking, is typically defined as the practice of providing loans and other financial services to businesses and individuals that own or operate commercial real estate. Commercial real estate is any income-producing real estate that is used for business purposes, such as office buildings, retail stores, hotels, and apartments.

CRE banks typically offer a variety of loan products, including:

CRE banks also offer a variety of other financial services, such as:

CRE banking is a specialized field of banking that requires a deep understanding of the commercial real estate market and the risks involved in lending to businesses and individuals who own or operate commercial real estate. CRE bankers must be able to assess the creditworthiness of borrowers, analyze the market value of commercial real estate, and manage the risks associated with CRE lending.

CRE Banking:

The Covercy Way

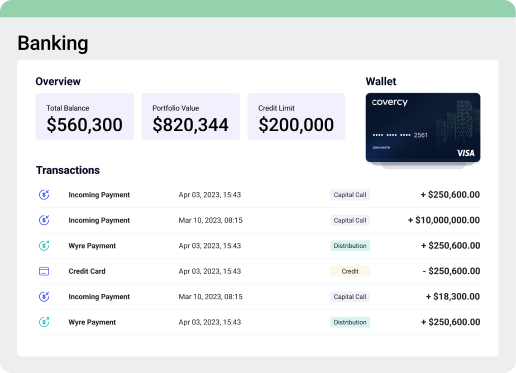

The banking features on the Covercy Platform give general partners (GPs) several benefits, including the ability to open bank accounts quickly and easily, organize bank accounts underneath assets or properties, and move money instantly via ACH debit between assets or to their investors, or from their investors into an asset account. One of the biggest differentiators for the banking features is that banking functionality is integrated right within the investor management platform, making it easy for GPs to manage their finances and stay organized.

Additionally, funds sitting in checking accounts opened with Covercy’s banking partner, Thread Bank, earn a high-yield APY while staying accessible and liquid. This is a hugely beneficial feature for GPs and their limited partners (LPs) who may have committed capital sitting uncalled in a savings account or checking account for months or even years during capital projects on a property or development. This money could be earning additional revenue for the GP, the LP, or the asset/property while it sits, but still be easily accessible should the need to call it sooner than planned arise.

Here are some additional details about each of these features:

Overall, on the Covercy Platform, the banking features offer several benefits for GPs and LPs. These features can help to streamline the financial management process, improve transparency, and generate additional revenue.

CRE Banking

Use Cases & Examples

Covercy is a software platform that provides investment management solutions for commercial real estate (CRE) deal sponsors. The company’s banking features allow sponsors to open bank accounts quickly and easily, organize bank accounts underneath assets or properties, and move money instantly via ACH debit between assets or to their investors, or from their investors into an asset account.

Covercy’s banking partner is Thread Bank, a well-established financial institution that offers a variety of banking services to its customers. Deposits are FDIC-insured for $250,000 for each account. With cash sweeping that deposits made with the company are insured up to $3,000,000 per depositor*. This provides sponsors with peace of mind knowing that their funds are safe and secure.

Here are a few sample scenarios demonstrating how Covercy’s CRE Banking features work to streamline operations, payments, and reporting for General Partners in the commercial real estate market.

CRE Banking

Benefits

Covercy is a valuable tool for CRE deal sponsors & general partners. It can help streamline banking operations, automate many administrative tasks, improve transparency for LPs, and even add a new revenue stream by taking advantage of high-yield APY rates on FDIC-insured cash accounts.*

CRE Banking

Mistakes to Avoid

Earn interest on bank account deposits. Manage multiple bank accounts per asset. Look at each account in an asset or all accounts aggregated to that asset.

| Regular Bank Account | Covercy CRE Bank Account ⁽¹⁾ | |

|---|---|---|

| Instantly Open Bank Accounts |  Manual Forms |  |

| Earn interest |  |  |

| Make ACH Payments Online |  |  |

| Multiple Accounts – Manage Accounts by Asset |  Flat List of Accounts |  |

| Pay Vendors and Suppliers Right from Asset Account |  |  |

| Auto-distribution & Capital Call Payments |  |  |

Covercy is a financial technology company. Banking provided by Thread Bank: Member FDIC.

“Before Covercy it felt like we were an accounting firm – that all we were doing was constantly making payments and dealing with bureaucracy, leaving us no time to truly grow our assets and portfolio. It was a colossal waste of time and energy.”

Ben Harlev

Ben Harlev

Managing Partner

Be Aviv

Not sure which is right for you?

Book a demo and we’ll help you decide.

*Covercy is a financial technology company, and is not a bank. Banking services provided by Thread Bank, Member FDIC.

The Covercy Visa Debit Card is issued by Thread Bank, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa is accepted.

**Your deposits qualify for up to $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://thread.bank/sweep-disclosure and a list of program banks at https://thread.bank/program-banks. Please contact customerservice@thread.bank with questions on the sweep program.

The Currency Cloud Limited (Non MIFID related products). Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorized by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199) Currencycloud Terms of Use All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Covercy Europe Limited. Registered in England No. 675000. Registered Office: 5 Elstree Gate, Elstree Way, Borehamwood, Hertforshire, WD6 1JD, UK

Covercy Technological Trading Limited. Registered in Israel No. 57797. Registered Office: 3 Ha-Yetsira St, Ramat Gan 5252141.

For clients based in the European Economic Area, payment services for Covercy Europe Ltd. are provided by CurrencyCloud B.V.. Registered in the Netherlands No. 72186178. Registered Office: Nieuwezijds Voorburgwal 296 – 298, Mindspace Nieuwezijds Office 001 Amsterdam. CurrencyCloud B.V. is authorised by the DNB under the Wet op het financieel toezicht to carry out the business of an electronic-money institution (Relation Number: R142701).

For clients based in the United States, payment services for Covercy Europe Ltd. are provided by The Currency Cloud Inc. which operates in partnership with Community Federal Savings Bank (CFSB) to facilitate payments in all 50 states in the US. CFSB is registered with the Federal Deposit Insurance Corporation (FDIC Certificate# 57129). The Currency Cloud Inc is registered with FinCEN and authorised in 39 states to transmit money (MSB Registration Number: 31000206794359). Registered Office: 104 5th Avenue, 20th Floor, New York , NY 10011.

For clients based in the United Kingdom and rest of the world, payment services (Non MIFID related products) for Covercy Europe Ltd. are provided by The Currency Cloud Limited. Registered in England and Wales No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199).

We use cookies to ensure that we give you the best experience on our website. By using our website, you agree to our privacy policy.

OkWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Privacy