Understanding the Real Estate Stack

All About The Real Estate Stack

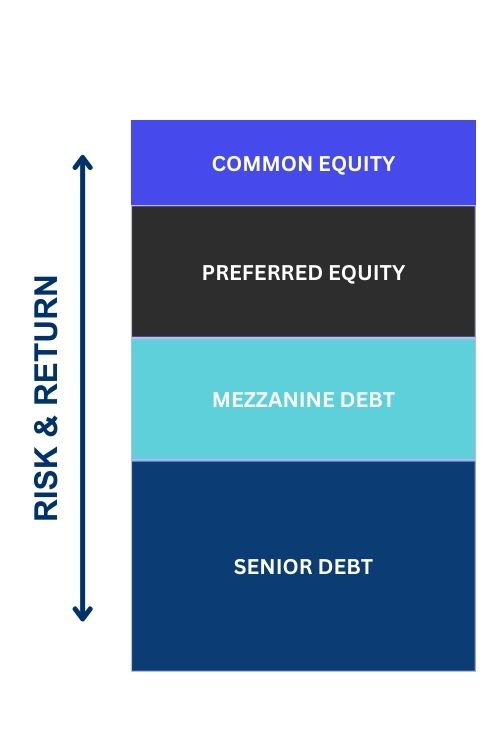

In real estate investment, the term “real estate stack” (also known commonly as the “capital stack“) is crucial for understanding how different layers of financing come together to fund a commercial real estate project. The real estate stack refers to the hierarchy of financial sources used to purchase, develop, and manage real estate properties. Each layer of the stack comes with its own level of risk, return, and priority in the event of liquidation.

The real estate stack typically includes a combination of debt and equity, structured in a way that balances the interests and risk appetites of various investors. Understanding the intricacies of the real estate capital stack is essential for both investors and developers, as it influences the financial performance and risk profile of the investment.

Real Estate Stack Layers

The real estate capital stack is composed of several layers that together form a “stack,” hence the name. Each layer brings its own distinct characteristics and implications for the investment. These layers include:

- Senior Debt:

- Senior debt is the most secure and lowest-risk layer of the capital stack. It typically comes from banks or institutional lenders and has the highest priority for repayment in case of liquidation. Senior debt holders receive fixed interest payments and have first claim on the property’s assets.

- Mezzanine Debt:

- Mezzanine debt is a hybrid between debt and equity, positioned below senior debt in the capital stack. It carries a higher risk compared to senior debt and, consequently, offers higher returns. Mezzanine lenders may have the option to convert their debt into equity or take ownership of the property if the borrower defaults.

- Preferred Equity:

- Preferred equity sits below mezzanine debt but above common equity. Investors in this layer receive fixed dividends and have priority over common equity holders in terms of repayment. Preferred equity offers a balance between risk and return, attracting investors looking for steady income with moderate risk.

- Common Equity:

- Common equity is at the bottom of the capital stack and carries the highest risk but also the highest potential returns. Common equity investors are the last to be repaid in the event of liquidation but benefit the most from the property’s appreciation and profitability. This layer typically includes the sponsor or developer and other equity investors.

The Real Estate Stack for a Fund vs. Syndication: Key Differences

Understanding the difference between a real estate stack for a fund versus a real estate syndication is crucial for tailoring the financial structure to meet specific investment strategies.

- Real Estate Fund:

- A real estate fund pools capital from multiple investors to invest in a diversified portfolio of properties. The real estate stack in a fund is designed to support multiple projects, spreading risk across different assets. Funds often employ a mix of senior debt, mezzanine debt, preferred equity, and common equity to optimize returns and manage risk effectively. The structured approach of a fund allows for more sophisticated financial strategies and better risk mitigation.

- Real Estate Syndication:

- Real estate syndication involves pooling capital from a group of investors to purchase a single property or a small group of properties. The capital stack in a syndication is tailored to the specific project, with a focused approach to financing. Syndications often rely heavily on senior debt and common equity, with less frequent use of mezzanine debt and preferred equity. The simpler structure of a syndication allows for more straightforward management and a clearer alignment of investor interests with the specific property’s performance.

How GPs Find Outside Investors

General Partners (GPs) play a critical role in raising capital for real estate investments. They utilize a variety of strategies to find outside investors:

- Networking:

- GPs often rely on their personal and professional networks to identify potential investors. Attending industry conferences, real estate meetups, and other networking events can help GPs connect with high-net-worth individuals and institutional investors.

- Marketing Campaigns:

- Effective marketing campaigns, including email marketing, social media outreach, and content marketing, can attract potential investors. GPs may use platforms like LinkedIn, Facebook, and specialized real estate forums to reach a broader audience.

- Investor Portals:

- Online investor portals and crowdfunding platforms have become increasingly popular. Sites like RealtyMogul, Fundrise, and CrowdStreet enable GPs to showcase their projects to a large pool of accredited investors.

- Referrals:

- Satisfied investors often refer GPs to their networks, creating a word-of-mouth effect that can lead to new investment opportunities.

- Partnerships:

- Collaborating with financial advisors, wealth managers, and family offices can help GPs gain access to a wider pool of potential investors.

Creative Ways to Structure Deals

General Partners (GPs) seeking innovative ways to structure real estate deals can benefit from exploring creative financing strategies that go beyond traditional methods. One such approach is the use of participating loans or shared appreciation mortgages.

In these structures, lenders not only receive interest payments but also a percentage of the property’s appreciation or cash flow. This aligns the interests of both parties and can make financing more attractive to lenders, particularly in high-potential markets. This approach can reduce the need for high equity contributions from investors, allowing GPs to leverage more capital while providing lenders with the potential for higher returns.

Another innovative strategy is the use of crowdfunding platforms to raise equity. By tapping into the collective power of a large number of small investors, GPs can amass significant capital without relying on a few large investors. This democratizes real estate investment, making it accessible to a broader audience and potentially speeding up the fundraising process. Additionally, preferred equity structures can be tailored to offer enhanced returns to early investors, incentivizing quick commitments and providing GPs with the necessary funds to kickstart their projects. These creative deal structures can provide GPs with the flexibility and capital needed to pursue ambitious projects while managing risk and optimizing returns.

Why Covercy is the Best Option for Managing Your Real Estate Stack & Commercial Projects

When it comes to managing your real estate stack, Covercy stands out, particularly for the platform’s fully integrated banking and payment options.

- Comprehensive Integration:

- Covercy offers a fully integrated investment management platform that combines investor relations, reporting, capital calls, distributions, and fund management. This holistic approach ensures that all aspects of your real estate operations are seamlessly connected, reducing manual effort and minimizing errors.

- Streamlined Banking and Payments:

- One of Covercy’s standout features is its robust banking and payment integration. This allows for efficient handling of all financial transactions, from rent collection and vendor payments to investor distributions and capital raising. The banking integration via Thread Bank allows GPs and LPs to instantly open bank accounts and even earn a high APY on any uninvested capital within those accounts. With Covercy, you can manage your finances with ease and transparency, ensuring timely and accurate payments.

- Enhanced Investor Experience:

- Covercy’s investor portal provides a user-friendly interface for investors to access their investment details, view performance reports, and receive updates. This enhances investor satisfaction and engagement, fostering stronger relationships and trust.

If Covercy sounds right for your firm, book a free demo today.