Debt Waterfall

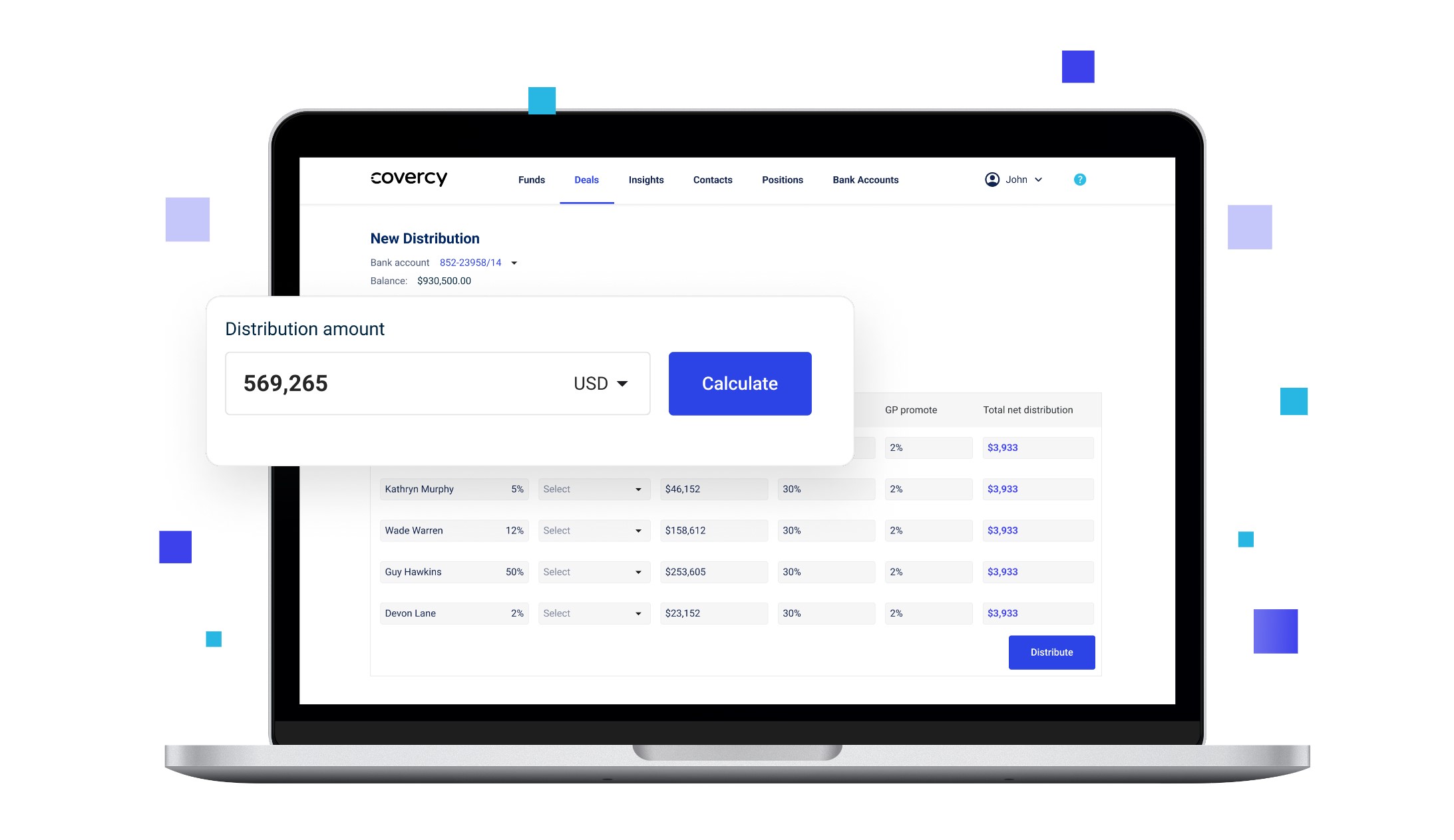

Commercial real estate syndicators rely on a variety of funding sources to close each new deal. It’s very common to combine equity and debt, but doing so can make calculating distribution payments to your Limited Partners even more complex. While waterfall models are primarily used to calculate distributions in equity deals, it’s possible to create a debt waterfall model to prioritize payment of debt obligations associated with either individual assets (properties) or real estate funds. In fact, Covercy is a commercial real estate platform specifically designed with General Partners in mind. Distribution waterfalls, including debt waterfalls, can be completely customized and automated right within your investment management tool.

Ready to learn how Covercy could work with your firm? Sign up for a free trial today.

What is a Distribution Waterfall?

In commercial real estate syndication, a waterfall model is a method used to allocate profits among the syndicator (or sponsor) and the investors (or limited partners) in a structured manner. It’s primarily used in equity deals, but the concept can be applied more generally as well. In an equity deal, the returns are generally less predictable than in a debt deal, and therefore, a waterfall structure is commonly used to align the interests of the sponsor and the investors.

Here’s a basic structure of a typical waterfall model in an equity deal:

1. Return of Capital

The first step in the waterfall is typically returning the initial capital contributions to the investors. Before profits are divided, investors get their initial investment back.

2. Preferred Return

Once the initial capital is returned, the next tier is the preferred return. This is a predetermined rate of return that investors receive before the sponsor gets any profit. It’s not a guarantee but a priority in payment. It might be, for example, an 8% annual return on investment.

3. Catch-Up

Some waterfalls include a catch-up tier, where the sponsor receives the majority or all of the profits until they have “caught up” to a predetermined percentage of the profits, aligning their overall share with that of the investors.

4. Profit Split

After the catch-up, remaining profits are typically split between the sponsor and the investors based on an agreed-upon percentage, which can be, for instance, 70% to investors and 30% to sponsors or some other agreed ratio.

Example:

- Return of Capital: $1,000,000 (Investors receive this amount first)

- Preferred Return: 8% (Investors receive an 8% return on their investment before the sponsor receives any profits)

- Catch-Up: Sponsor receives enough to ensure they have 20% of profits up to this point.

- Profit Split: Remaining profits are split 80% to investors and 20% to the sponsor.

What is a Debt Waterfall?

A debt waterfall refers to a priority order or hierarchy in which cash flows are used to repay the debt obligations within a structured finance transaction, such as commercial real estate financing. It outlines the sequence in which cash generated by an asset or a pool of assets is allocated to various debt tranches, starting from senior to subordinate.

Structure of a Debt Waterfall:

- Senior Debt:

- The first tier in the debt waterfall is usually reserved for repaying the senior debt, which is considered the least risky tranche and thus has the lowest interest rate. It often includes bank loans and other forms of secured debt.

- Mezzanine Debt:

- After the senior debt is serviced, the next debt waterfall tier is typically the mezzanine debt. It carries higher risk and therefore a higher interest rate compared to senior debt.

- Subordinated or Junior Debt:

- Following mezzanine debt repayment, any remaining cash flow may be allocated to subordinated or junior debt, which bears the highest risk and therefore typically commands the highest interest rate.

- Equity Holders:

- Once all the debt service obligations are met, any residual cash flows are distributed to the equity holders. Equity holders assume the most risk but also stand to gain the most if the project performs well.

Example of a Debt Waterfall in Real Estate:

- Cash Flow from Property: $100,000

- Senior Debt Service: $40,000 (Paid first)

- Mezzanine Debt Service: $30,000 (Paid after Senior Debt)

- Subordinated Debt Service: $20,000 (Paid after Mezzanine Debt)

- Equity Holders: $10,000 (Received last)

The specifics of the debt waterfall can vary depending on the contractual agreements and can be quite complex, incorporating features like cash reserves, payment triggers, and performance-related covenants.

Debt Waterfall for Properties or Funds

Debt deals can be executed on both individual properties or assets and as part of real estate funds. There isn’t a singular approach, and the structure of a debt deal largely depends on the strategy and preference of the investors and sponsors. Below is a brief explanation of how debt deals can be executed in both contexts:

1. Individual Properties or Assets:

Debt deals can certainly be done on individual properties or assets. For example, an investor or a group of investors may lend money to a property owner, secured by a mortgage on a specific property. This is quite common and allows the lender to have a secured interest in a specific asset, providing a level of risk mitigation. The terms of the debt, including interest rates, repayment schedules, and covenants, are typically negotiated and agreed upon based on the specifics of the individual property or asset.

2. Real Estate Funds:

Debt deals can also be executed through real estate debt funds. In this scenario, investors pool their money into a fund that specializes in originating or acquiring real estate loans. These funds can lend money to various real estate projects, diversifying the risk across multiple properties or assets. The fund’s management selects the investments and manages the overall portfolio, and the investors in the fund earn returns based on the performance of the portfolio of loans. Learn more about how to start a real estate fund here.

With Covercy, GPs Can Automate Each Distribution & Debt Waterfall

Covercy’s fully customizable and integrated waterfall modeling includes the following robust features for General Partners and commercial real estate syndicators:

Advanced Amortization Schedule Calculations:

Covercy can adeptly handle amortization schedule calculations for a complex matrix of investors, enabling precise, tailored financial planning and execution.

Fully Customizable Payment Schedules:

Covercy gives GPs unparalleled flexibility by offering customizable payment schedules and calculation types, adaptable to varying investor requirements, ensuring each investor’s unique needs are met.

Individual Investor Customization:

Covercy provides the ability to modify schedules and calculations down to the individual investor, allowing for meticulous management and addressing investor-specific preferences or constraints.

Banking Integration:

Covercy CRE Banking enables instant transfers of funds through ACH debit, allowing seamless transactions from the asset’s account to the individual investor’s account after running the requisite waterfall calculations.

Debt Waterfall Benefits to a Real Estate GP:

Enhanced Investor Relations:

The ability to tailor payment schedules and calculations to individual investors demonstrates a high level of commitment and service, fostering trust and satisfaction among investors, which can lead to long-term relationships and additional investment opportunities.

Efficient Capital Management:

The advanced and customizable features of Covercy allow for streamlined and accurate capital management, enabling General Partners to optimize financial strategies, reduce errors, and save time, allowing them to focus more on value-added activities like sourcing deals and managing assets.

Risk Mitigation:

By providing precise amortization calculations and customizable payment schedules, General Partners can mitigate the risk of financial inaccuracies and discrepancies, thus avoiding potential conflicts and ensuring smooth and transparent financial transactions with investors.

Seamless Transaction Execution:

Covercy’s integrated banking enables General Partners to not only run accurate calculations but also instantly execute transactions, moving money seamlessly to individual investor accounts. This feature enhances operational efficiency and ensures timely distribution payments, further bolstering investor confidence and satisfaction.

Try Covercy free.

Ready to take Covercy for a spin? Sign up free or request a demo today.