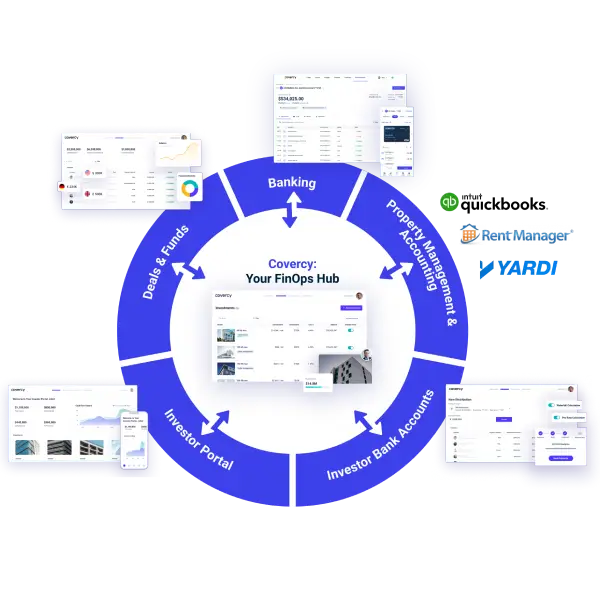

Consider all your financial operations handled.

While you focus on scaling your firm, Covercy’s end-to-end financial operations (FinOps) framework connects disparate systems data, simplifying administrative tasks and giving you valuable time back in your day.

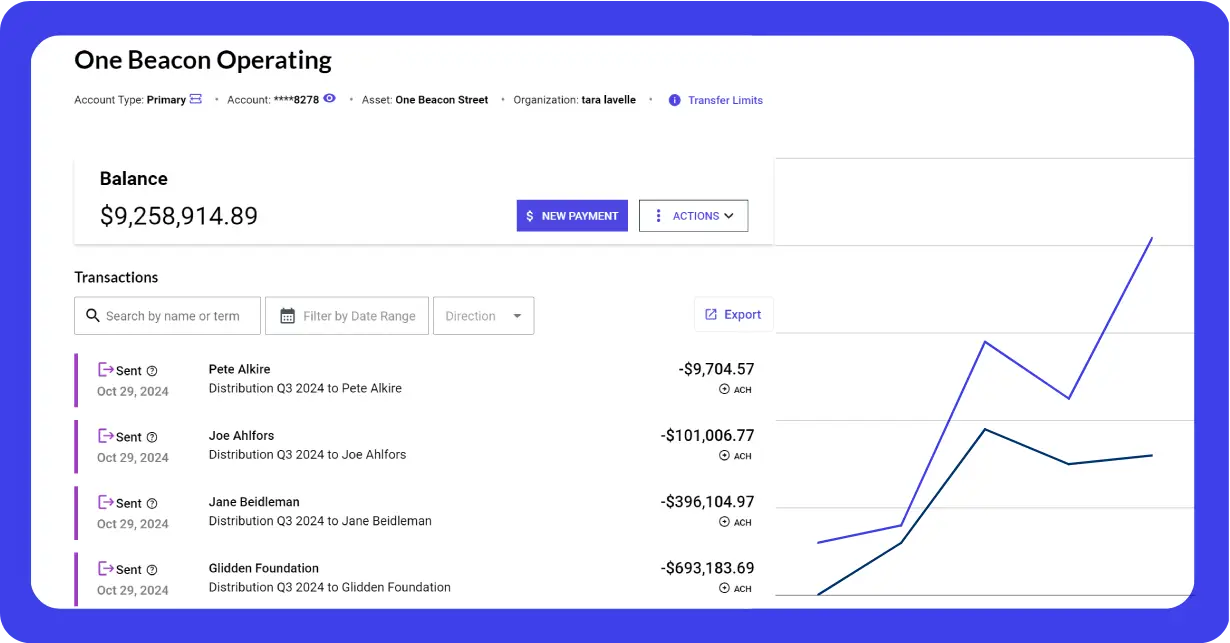

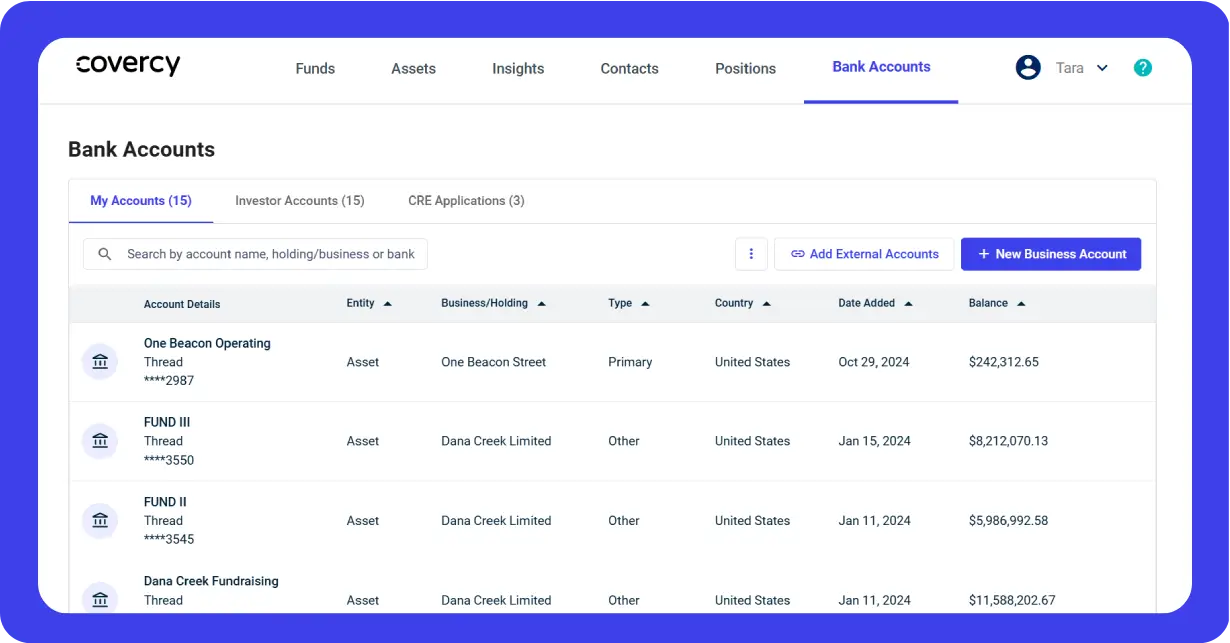

Covercy is a financial technology company, and is not a bank. Banking services provided by Thread Bank, Member FDIC.