Three Advantages of Fund Distribution Automation Software

With Greater Success Comes Greater Complexity

We’re sure the headline piqued your interest because you — just like many other commercial real estate GPs — are likely managing the distribution process manually. Even if you’re already using a technology solution to prepare and manage distributions, it’s likely you’re taking the funds across the finish line yourself — either by setting up an ACH transaction, contacting your bank to wire the funds, or even sending (or dropping off!) checks.

This process gets more complex when a property has a variety of investors with varying levels of investment. As the property begins to succeed and generate more revenue, you’ll need to provide returns to your investors. Depending on the number of investors a property has, calculating these can be an extremely time-consuming and manual process. And, if the property has a waterfall structure tied to it, that complexity only increases more.

Additionally, if your investment structure has a GP promote component built into it, you’ll need to build that into the calculation as well to ensure you’re compensated for your efforts in managing the fund and property itself. The icing on the cake is that you’re likely having to deal with this for every property under your management. Even handling distributions quarterly means this is a significant undertaking, either on your part or that of your team.

Clearly, there’s never been a more important time to consider a solution for fund distribution automation. Here, we’ll explore a few advantages that such a platform provides.

3 Benefits of Fund Distribution Automation Software

1. You Can Factor Pro-Rata Ownership into Your Distributions

Investors participating in a deal are all doing so at different levels. While you’ll likely have some that have bought in at the minimum level, others will invest according to their own financial strategy. This means you have a number of different pro-rata calculations to consider when executing distributions. If you’re doing these manually, you’re likely spending a lot of time here. Manual work also creates unnecessary risk in that you or your team could make a mistake, which creates confusion and extra hassle to resolve.

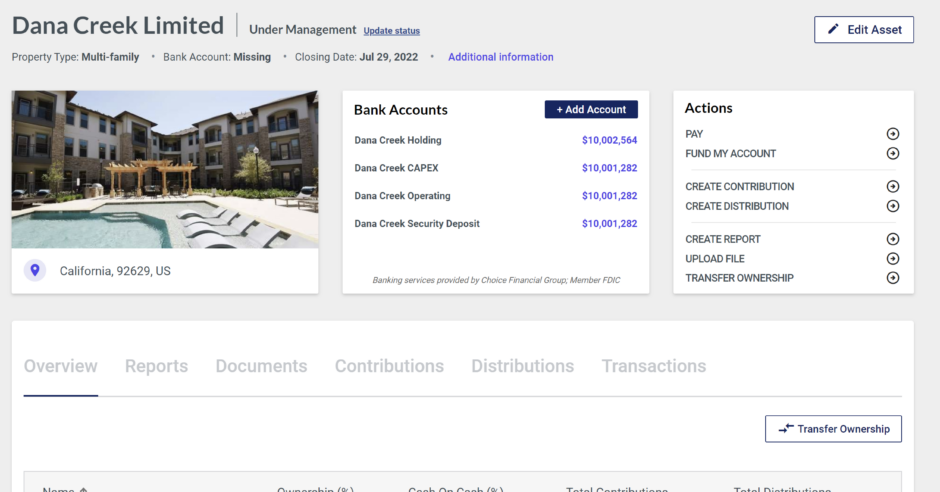

Managing this is just another administrative component that takes your focus away from building stronger relationships, overseeing properties, and hunting for new deals. With Covercy, you can automatically calculate distributions based on each investor’s pro-rata ownership of the property or fund. You can also build more complex waterfall models right within the platform. When using our fund distribution automation platform, this further expedites what is already a streamlined distribution process and allows you to get back to doing what you do best.

2. GP Promote Allocations Can Be Included

You deserve to receive — and are likely incentivized with — compensation for managing the investment process, closing the deal, overseeing each property in your portfolio, and managing distributions to your investors. It’s time-consuming work, with or without fund distribution automation software to help streamline what is only a piece of a bigger responsibility. If your deals include a GP promote component, you can save time and effort by including those calculations in the automated quarterly distribution.

With Covercy, GP promote can be included in the above-mentioned pro-rata calculations. And, if your deals have a waterfall component attached to them, those calculations can be imported into the system and included in the distribution process as well. So if your compensation increases as the property does better and better, you’ll be able to quickly and efficiently receive your just earnings along with providing rapid distributions to investors in their preferred currency, whether domestic or international.

Explore more in distribution: Learn how Covercy excels with automated distributions.

3. Speed — and Value — Are Increased

In addition to simplifying your workload and allowing you more time to focus on your investors and properties, fund distribution automation allow you to deliver what your investors want, faster: their returns. Gone are the days when you and your team have to spend countless hours and days sifting through the calculations and spreadsheets mentioned above — now, you can import the data you need for an asset or fund (such as investor info, bank account information, pro-rata ownership, and more) into one system and execute distributions in a matter of clicks.

Investors receive a notification with the complete details of the distribution and, if you choose to include it, a personalized message from you. After selecting a gross distribution amount, you can also select tax withholding as well as indicate adjustments as needed. If your investors have multiple bank accounts, the system will automatically default to the most recent account used. Collectively, these features make Covercy the fastest, most efficient, and investor-focused platform available for CRE GPs.

Experience a New Approach to Fund Distribution Automation

Distributions are a critical part of your work as a GP. Your investors are everything, and ensuring they’re satisfied with their decisions and returns is of the utmost importance. Covercy’s automated distribution capabilities empower you to ensure exactly that, but they’re far from the only advantage the system offers:

- Helps prevent phishing and fraud via enhanced security

- Supports complex investment structures like private equity

- Provides investors with an elegant, easy-to-use portal

- Enables greater communications with investors

- Allows GPs to prepare performance reports and share documents

- Provides fundraising solutions and investor activity tracking

- Allows for creation and management of capital calls