Investor

management

done right

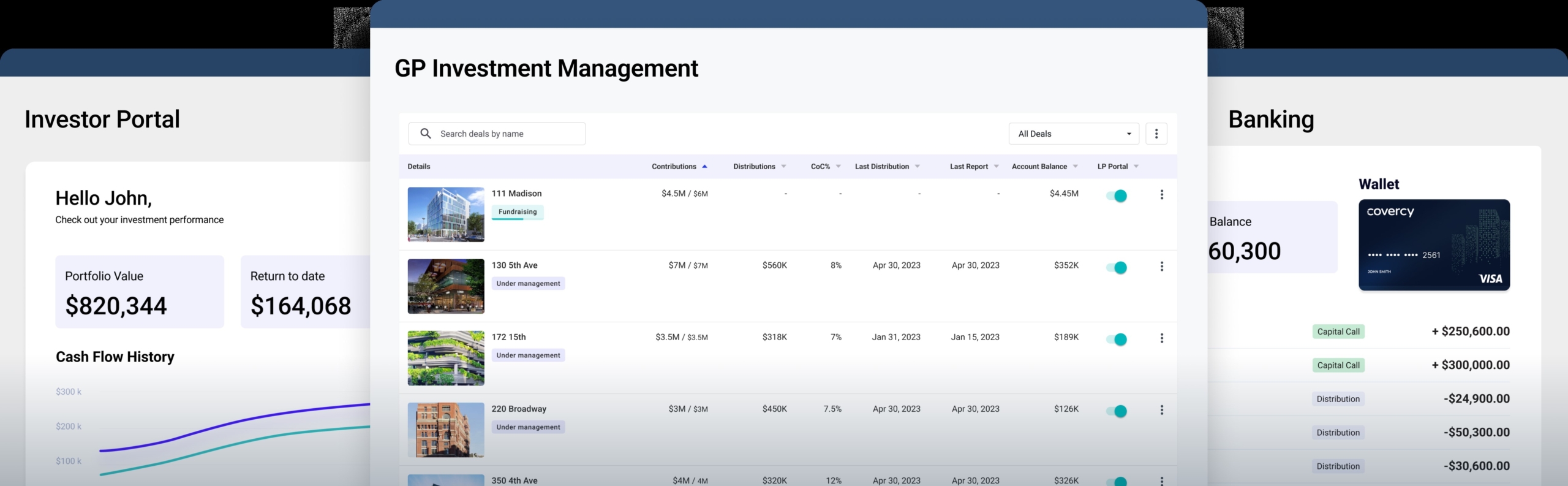

Everything a commercial real estate GP needs to manage investors – all in one place, all with Covercy.

|

Covercy launches AI |

We’ve just launched a new feature to enhance your experience.

Everything a commercial real estate GP needs to manage investors – all in one place, all with Covercy.

Investor Management

Features & Pricing

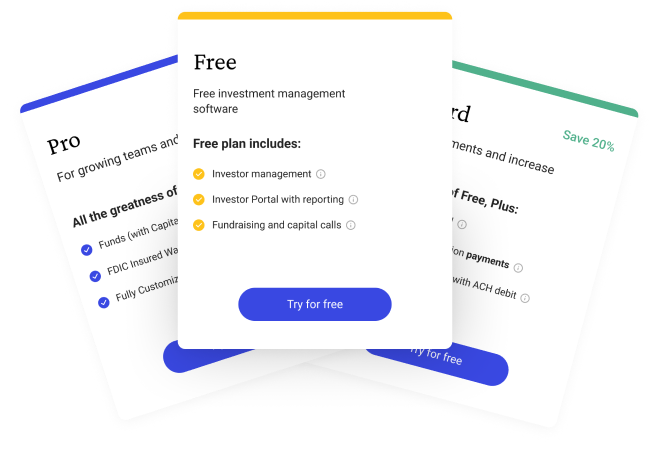

Many investor management tools offer customized pricing based on features, assets under management (AUM), or professional service add-ons. Covercy offers general partners (GPs) three subscription-based tiers, beginning with one that is completely free forever for the first three assets you manage.

Additionally, Covercy’s embedded banking integration means GPs and LPs can hold uninvested capital in checking accounts within the platform, earning high-interest rates and offsetting software costs.

Standard features include a robust and user-friendly investor portal, distribution payments and management, performance reporting, document management, deal management, fundraising with capital calls, and more.

Investor Management

in Real Estate

Real estate general partners (GPs) or deal sponsors have a lot on their plate, from sourcing and evaluating deals to fundraising, reporting, and processing distribution payments to limited partners (LPs).

The world of investor management in commercial real estate can be complex, especially for GPs who take outside investors and must manage the communication, reporting, and distributions for a high volume of holdings.

Covercy offers several investment management software packages based on each firm’s unique needs, including a forever-free version for up to three assets. Covercy software is designed to flex and grow with you, but each tier includes core investor management solutions like deal pages, an investor contacts database, investor communications tools, asset and commercial property management, and investment performance reporting for your LPs.

The Key Components

of Investor Management

Investor management typically involves several key components, including:

Investor Management

Best Practices

To summarize, investors want their investment to pay off, and they want to trust that you as the GP are the right person for the job.

Adhering to these investor management best practices will help build trust and rapport with LPs, especially for GPs who are managing a higher volume of outside investors in the commercial real estate space:

Investor Management

Mistakes to Avoid

For instance, a GP may promise a 20% return on investment in a commercial property in an area that is already saturated with similar properties and has a history of lower rental rates. If the GP does not perform thorough due diligence on the property and its market conditions and does not factor in the risks involved, the investment may not achieve the promised return, resulting in a loss for the investor. This can lead to investor dissatisfaction and potential legal action against the GP for misrepresenting the investment opportunity. It is crucial for GPs to avoid making unrealistic promises to investors and instead provide accurate and transparent information to manage expectations effectively.

Generally speaking, it is not advisable for a GP to make a guarantee on returns for an investment in commercial real estate.

This is because real estate investments involve inherent risks that are often difficult to predict or control, such as changes in market conditions, unexpected maintenance or repair costs, and tenant turnover.

Making guarantees on returns can create unrealistic expectations and lead to legal and reputational risks for the GP. If the investment does not perform as guaranteed, investors may become dissatisfied and may even take legal action against the GP for breach of contract or misrepresentation.

That being said, in some cases, a GP may be able to make limited guarantees, such as a minimum return on investment for a specific period. However, even in these cases, it is essential to ensure that the guarantee is realistic and that investors are aware of the risks involved in the investment.

Let’s say that a GP has raised a fund for investing in commercial real estate properties and has a group of outside LPs who have invested in the fund. The GP is responsible for managing the fund, making investment decisions, and communicating with the LPs about the performance of the fund..

However, the GP fails to communicate effectively with the LPs, providing sporadic and incomplete updates on the fund’s performance and does not respond promptly to investor inquiries or concerns. This lack of communication leads to frustration and distrust among the LPs, who begin to question the GP’s ability to manage the fund effectively.

As a result, some LPs may decide to withdraw their investments, and the GP may have difficulty raising additional capital for future funds. Moreover, poor communication can damage the GP’s reputation in the industry, making it more challenging to attract investors and find additional appealing investment opportunities.

Let’s say that a GP is considering acquiring an industrial property that is being sold at a discount due to its current condition. The GP conducts a cursory inspection of the property and decides to purchase it without performing a thorough due diligence process.

After the acquisition, the GP discovers several unexpected issues with the property, such as a faulty roof, outdated electrical systems, and asbestos insulation. The cost of repairing these issues is much higher than the GP had anticipated, and the property’s income-generating potential is lower than expected due to a high vacancy rate.

As a result, the property’s cash flow is significantly lower than projected, and the GP is unable to provide the expected returns to the investors. The investors become frustrated and may take legal action against the GP for failing to perform proper due diligence and misrepresenting the investment opportunity.

As a result, the property’s cash flow is significantly lower than projected, and the GP is unable to provide the expected returns to the investors. The investors become frustrated and may take legal action against the GP for failing to perform proper due diligence and misrepresenting the investment opportunity.

Investor Management

Software

A key value at Covercy is our belief that every general partner or deal sponsor deserves robust software tools to support their firm’s growth.

Covercy offers several investment management software packages designed to scale and grow with you, including a forever-free version for up to three assets.

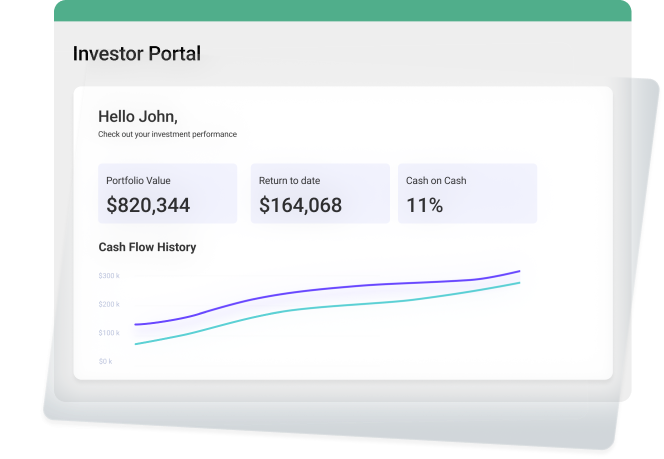

Covercy investment management software is the first platform to give GPs and LPs integrated banking and payments technology. What this means for GPs is that capital contributions from LPs and distribution payments to LPs can be done instantly via ACH debit, from one bank account to another, no wires or paper checks required

Another major benefit for both GPs and LPs who use Covercy is the latest introduction of the Covercy Wallet.

The Covercy Wallet is a digital wallet that stores bank accounts and debit cards in one centralized location. Accounts or fund sources can be assigned for each property, fund, or individual, depending on the circumstances, and access to funds can be restricted and customized to specific signatory users.

Additionally, cash held in an account created with Covercy is eligible to earn high-yield APY rates – turning uninvested or uncalled but committed capital into another revenue stream – while still being instantly accessible for withdrawal or transfer.

“We started with a pilot to automate distributions and centralize investor management. We’ve tripled our Covercy usage within six months. We’re never going back to manual.”

Not sure which is right for you?

Book a demo and we’ll help you decide.

*Covercy is a financial technology company, and is not a bank. Banking services provided by Thread Bank, Member FDIC.

The Covercy Visa Debit Card is issued by Thread Bank, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa is accepted.

**Your deposits qualify for up to $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://thread.bank/sweep-disclosure and a list of program banks at https://thread.bank/program-banks. Please contact customerservice@thread.bank with questions on the sweep program.

The Currency Cloud Limited (Non MIFID related products). Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorized by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199) Currencycloud Terms of Use All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Covercy Europe Limited. Registered in England No. 675000. Registered Office: 5 Elstree Gate, Elstree Way, Borehamwood, Hertforshire, WD6 1JD, UK

Covercy Technological Trading Limited. Registered in Israel No. 57797. Registered Office: 3 Ha-Yetsira St, Ramat Gan 5252141.

For clients based in the European Economic Area, payment services for Covercy Europe Ltd. are provided by CurrencyCloud B.V.. Registered in the Netherlands No. 72186178. Registered Office: Nieuwezijds Voorburgwal 296 – 298, Mindspace Nieuwezijds Office 001 Amsterdam. CurrencyCloud B.V. is authorised by the DNB under the Wet op het financieel toezicht to carry out the business of an electronic-money institution (Relation Number: R142701).

For clients based in the United States, payment services for Covercy Europe Ltd. are provided by The Currency Cloud Inc. which operates in partnership with Community Federal Savings Bank (CFSB) to facilitate payments in all 50 states in the US. CFSB is registered with the Federal Deposit Insurance Corporation (FDIC Certificate# 57129). The Currency Cloud Inc is registered with FinCEN and authorised in 39 states to transmit money (MSB Registration Number: 31000206794359). Registered Office: 104 5th Avenue, 20th Floor, New York , NY 10011.

For clients based in the United Kingdom and rest of the world, payment services (Non MIFID related products) for Covercy Europe Ltd. are provided by The Currency Cloud Limited. Registered in England and Wales No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199).

We use cookies to ensure that we give you the best experience on our website. By using our website, you agree to our privacy policy.

OkWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Privacy