Commercial real estate General Partners (GPs) who manage outside investors, syndications, and real estate funds face several common concerns during tax season. They often worry about:

- Compliance and Accuracy: Ensuring all financial activities are correctly reported according to the latest tax codes and regulations. Tax laws frequently change, and staying compliant is crucial to avoid penalties.

- Complexity of K-1 Distribution: The K-1 form reports an investor’s share of income, deductions, and credits from the syndication or fund. Managing and distributing K-1s can be complicated due to the detailed and individualized information required for each investor.

- Timeliness: There’s a tight timeline to distribute K-1 forms to ensure investors have them in time to file their own taxes. Delays can frustrate investors and potentially lead to financial or legal repercussions.

- Data Management and Security: Handling sensitive financial and personal information requires robust systems to ensure data integrity and security against breaches.

- Investor Relations: Maintaining transparent and positive communications with investors about tax matters is vital. This includes promptly addressing concerns, providing clear information, and ensuring investors understand their tax documents.

To manage these challenges, especially the real estate K-1 distribution process, GPs typically rely on a combination of strategies:

- Technology Solutions: Utilizing real estate K-1 distribution process software to automate and streamline financial reporting, tax calculations, and document generation. K-1 distribution software is ideally embedded right within your investment management platform, keeping all documents centralized and secure.

- Professional Services: Some GPs engage tax advisors and accountants who specialize in commercial real estate investment management, specifically real estate real estate K-1 distribution management, to ensure accuracy and compliance. Smaller firms, however, are typically capable of handling K-1 distribution themselves.

- Investor Portals: Offering online platforms where investors can access their K-1 forms and other relevant documents securely, which improves efficiency and reduces the risk of errors.

An investment management tool like Covercy can help streamline tax season for GPs in several ways:

- Automation of K-1 Distribution: Automating real estate K-1 distribution management can significantly reduce the time and effort required, ensuring timely delivery to investors.

- Data Consolidation and Accuracy: By centralizing investment, financial, and tax data, Covercy can help ensure accuracy and consistency across all documents, reducing the risk of errors.

- Improved Investor Communication: Covercy includes secure investor portals that provide real-time access to tax documents and investment reports, improving transparency and investor satisfaction.

- Enhanced Compliance and Security: With Covercy, GPs have built-in compliance checks and secure data storage to meet regulatory requirements and protect sensitive information.

- Efficiency and Cost Savings: Streamlining these processes can lead to operational efficiencies, reducing the need for extensive manual work and potentially lowering costs associated with tax preparation and distribution.

By addressing the common concerns of GPs and offering solutions to streamline the K-1 distribution process, investment management tools like Covercy play a crucial role in simplifying tax season for real estate investment managers.

How Covercy Streamlines the Real Estate K-1 Distribution Process for GPs

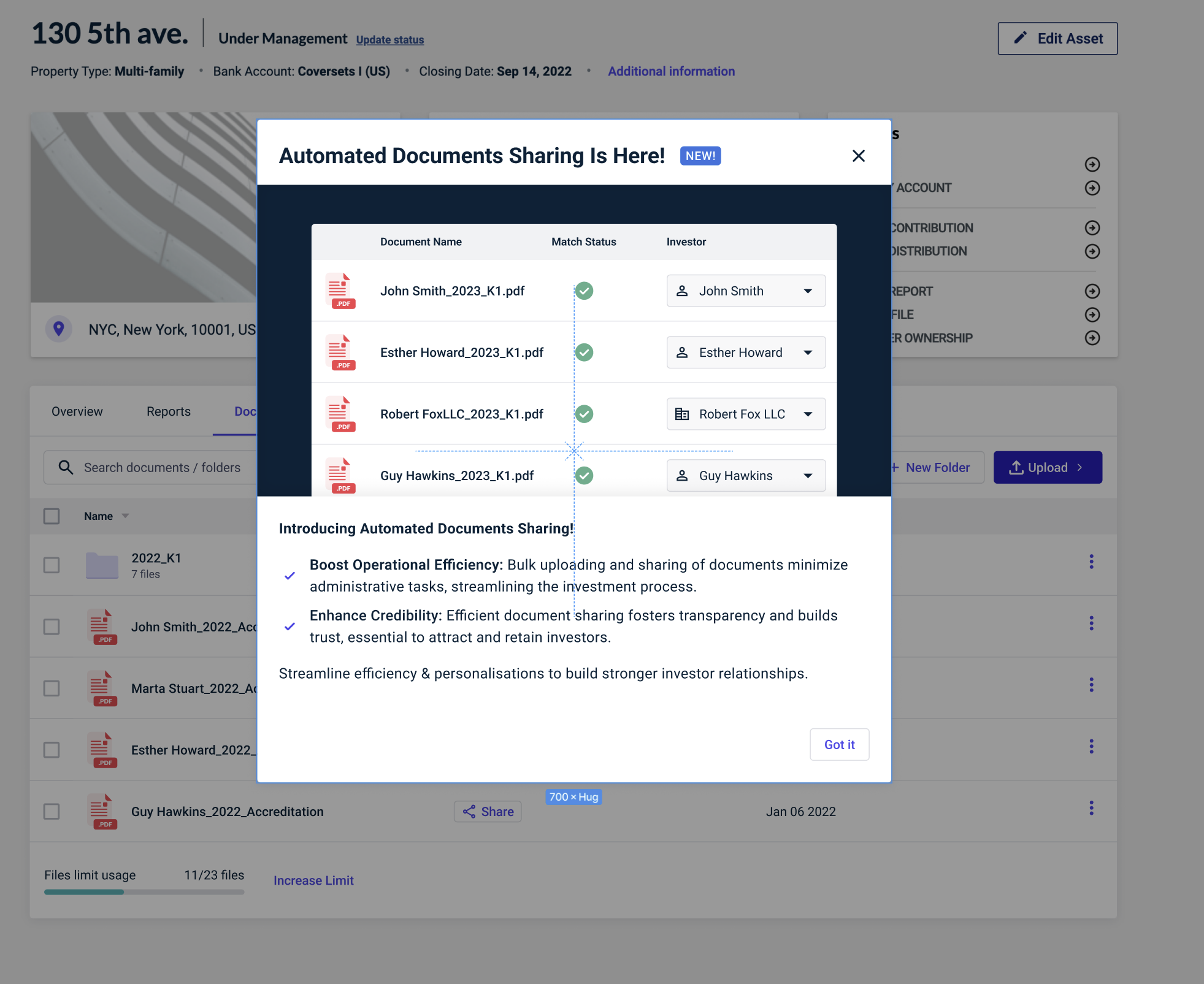

Covercy recently introduced a new product feature that helps GPs automate document sharing, including tax documents like K-1s. GPs who use Covercy’s investment management platform to manage multiple outside investors and holdings can now bulk upload, auto-match, and distribute K-1 forms to their investors in a few simple clicks. Read the step-by-step instructions here.

Once all K-1 forms are uploaded and distributed, your investors can easily log into their investor portal to access and download their K-1 forms, plus any other relevant documents you share with them regularly. All recurring tax forms will be stored within their portal, giving them easy access to all historical data.

Why is this so important? Instead of your LPs contacting you to send (and re-send… and re-send) the same documents over and over again, they’ll have everything they need instantly—freeing up your time to deliver value elsewhere, and freeing up their time to find new deals to invest in.

If you are a commercial real estate GP evaluating investment management solutions, Covercy offers a free version for GPs managing up to 3 assets. Try it out today.

RECENT POSTS

- The Rise of Net-Zero Buildings: Transforming Sustainable Real Estate

- Elevating Tenant Experience: The New Standard in Commercial Real Estate

- Behind the Latest Surge in Trophy Office Development

- Covercy Appoints Peter Sanchez as President to Accelerate U.S. Growth and Institutional Capabilities

- Dominating the Skyline: The U.S. Edge in Global Real Estate Development

We use cookies to ensure that we give you the best experience on our website. By using our website, you agree to our privacy policy.